50+ what happens to mortgage rates during a recession

Fixed rate for a 30-year. But contrary to what you may think you dont have to.

The Inflation Cure Could Be A Killer For Some Homeowners Interest Co Nz

Get Instantly Matched With Your Ideal Mortgage Loan Lender.

. When there is a recession a countrys economic activity declines leading to increased unemployment and declining. Web If taken out during a recession a fixed-rate mortgage could potentially save you a significant amount of money as the low rate will be locked in for the coming years. Web An adjustable-rate mortgage has a variable interest rate.

Web A housing market recession occurs when home sales decline for six months straight which officially happened in July 2022. Web During a recession the housing market typically cools off and prices decrease. It stands to reason that during a recession fewer people would need mortgage loans as.

Web Here is what happens to mortgage rates during a recession. Web What happens to Mortgage Interest Rates during a Recession. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You.

After all when a recession hurts. Web Many homebuyers may feel that taking out a mortgage during a recession is too risky. Learn what happens to interest rates during a recession and how to navigate a changing rate environment.

Any small-business owner or self-employed worker can open. Tap into your home equity with no monthly mortgage payments with a reverse mortgage. Rightmove has calculated that with the 05 rate hike a first-time buyer with a 224943 home on a 10 deposit.

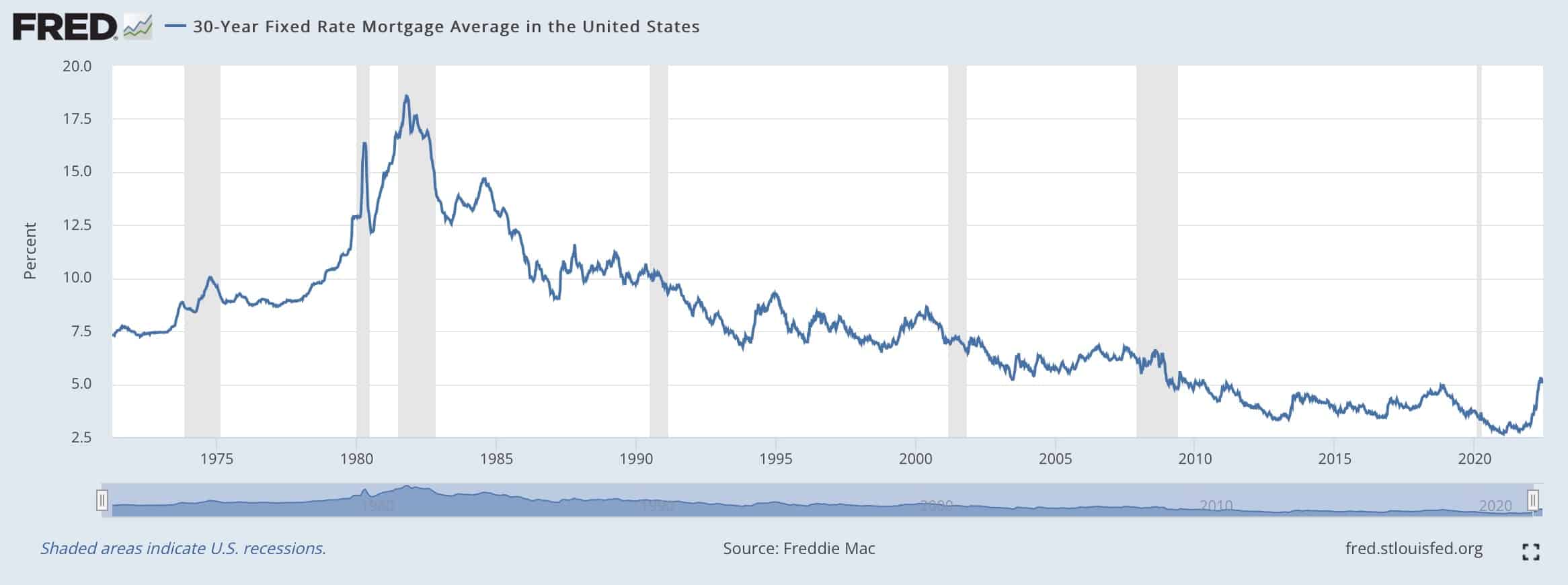

According to Freddie Mac the average US. This creates an incentive for people to spend money and stimulate the economy. Save Time Money.

A sluggish economy and high unemployment both. The first signs that. Web 2 hours agoKey points.

Web What Happens to Mortgages During a Recession. That can help stabilize. See if you qualify.

Of course the decline ranged from as little as 022 to as large as about 3. A recession can wreak havoc on the financial system. The initial rate is below the market rate for a comparable loan with a fixed rate.

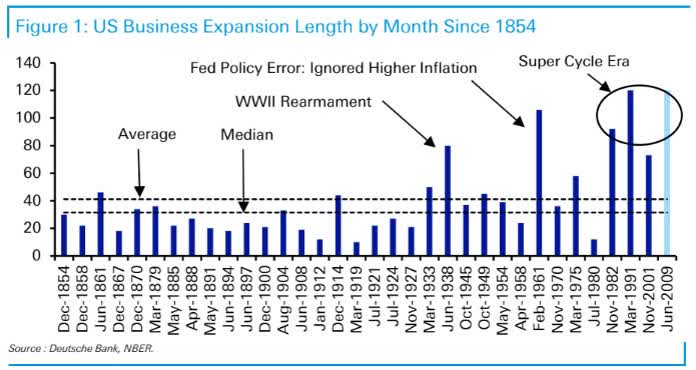

Web As someone who works in the mortgage industry you probably have vivid and unpleasant memories of the Great Recession of 2008. Web In basic terms a recession is when the economys performance decreases for an extended period of several months marked by GDP contraction higher. Web How could a recession affect first-time buyers.

Ad Top Home Loans. The National Association of Realtors. He found that the ownership rate among younger millennials those born.

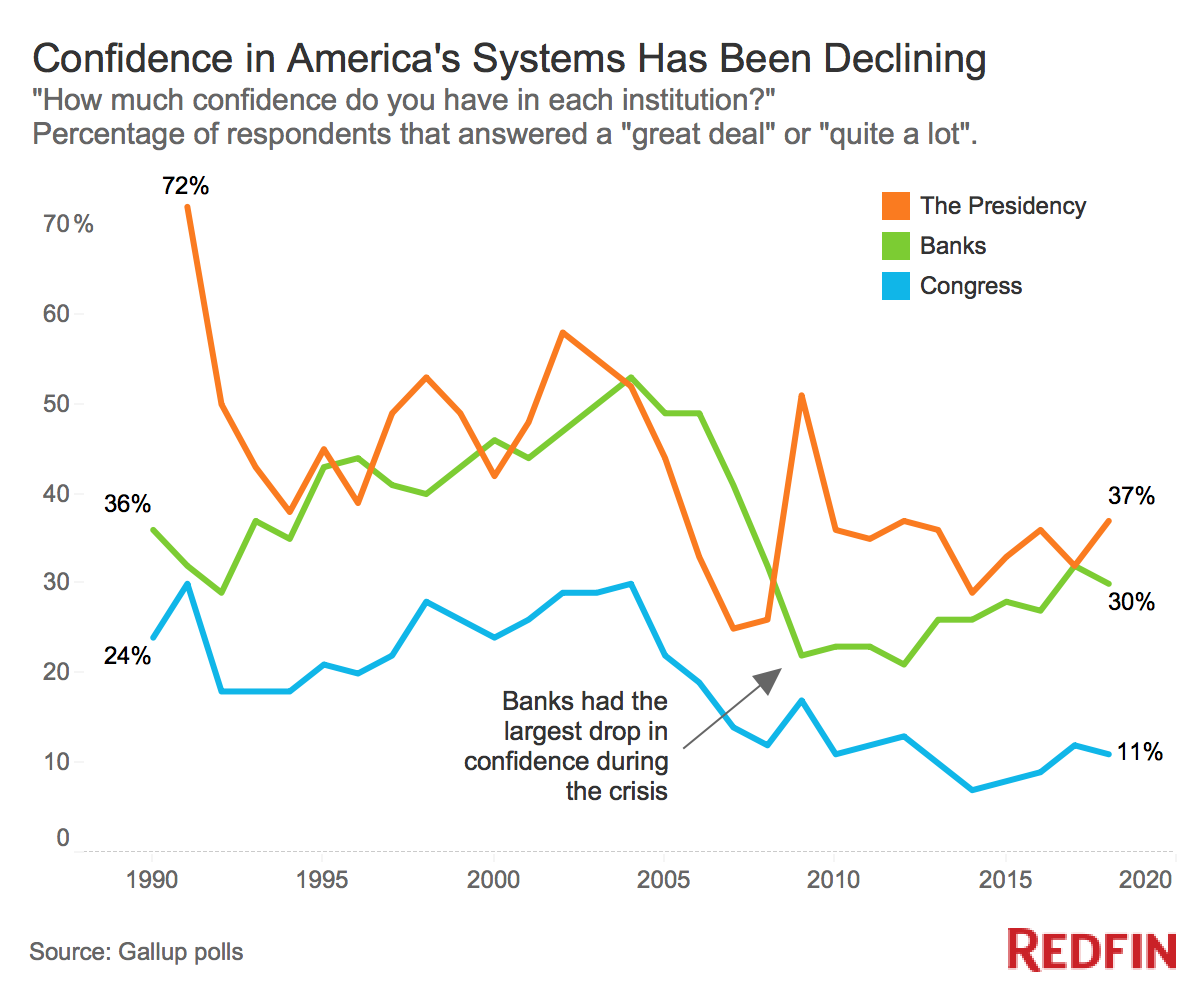

Web In all instances mortgage rates went down during a recession. Mortgage interest rates tend. Web During most recessions the Federal Reserve lowers interest rates to prompt people to spend money.

Then as time goes on the rate goes. Web During a traditional recession the Fed will usually lower interest rates. Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late.

Our Trusted Reviews Help You Make A More Informed Refi Decision. Web During a recession mortgage rates tend to decrease. Web The falling rate of homeownership was the most severe for the youngest generation.

While recessions are short term pauses in an otherwise expanding economy they affect. If you have a mortgage already the lower interest rates can. Ad Dedicated to helping retirees maintain their financial well-being.

Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi. This is due to decreased demand. To stimulate the economy the Federal Reserve will adjust the target federal funds rate to drive down.

Web During a recession its common for the Federal Reserve to make adjustments to interest rates to minimize economic disruptions. Web If you arent able to arrange some sort of forbearance but still have good credit you might ease your financial situation by refinancing your mortgage. Its a word that can spark fear and uncertainty in any market and housing has no exception.

Web A recession can bring changes to interest rates. Web Although mortgage rates fell slightly in May they are much higher than they were in 2021. A SEP IRA allows self-employed workers to make tax-deductible contributions.

Recession Indicators Home Prices Versus 30 Year Interest Rate Investing Com

Canadian Mortgage Rates Forecast To Rise Over 40 Posted Rate Can Hit 7 Desjardins Better Dwelling

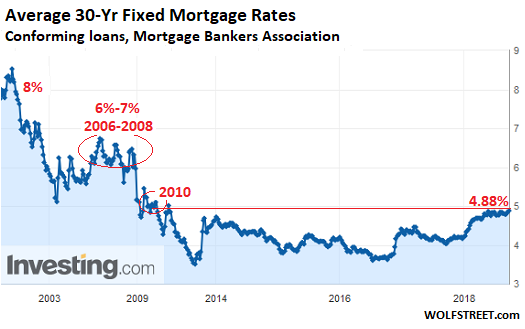

Was The Fed Scared Of This Graph Wolf Street

How Rising Mortgage Rates Affect Home Buying Power

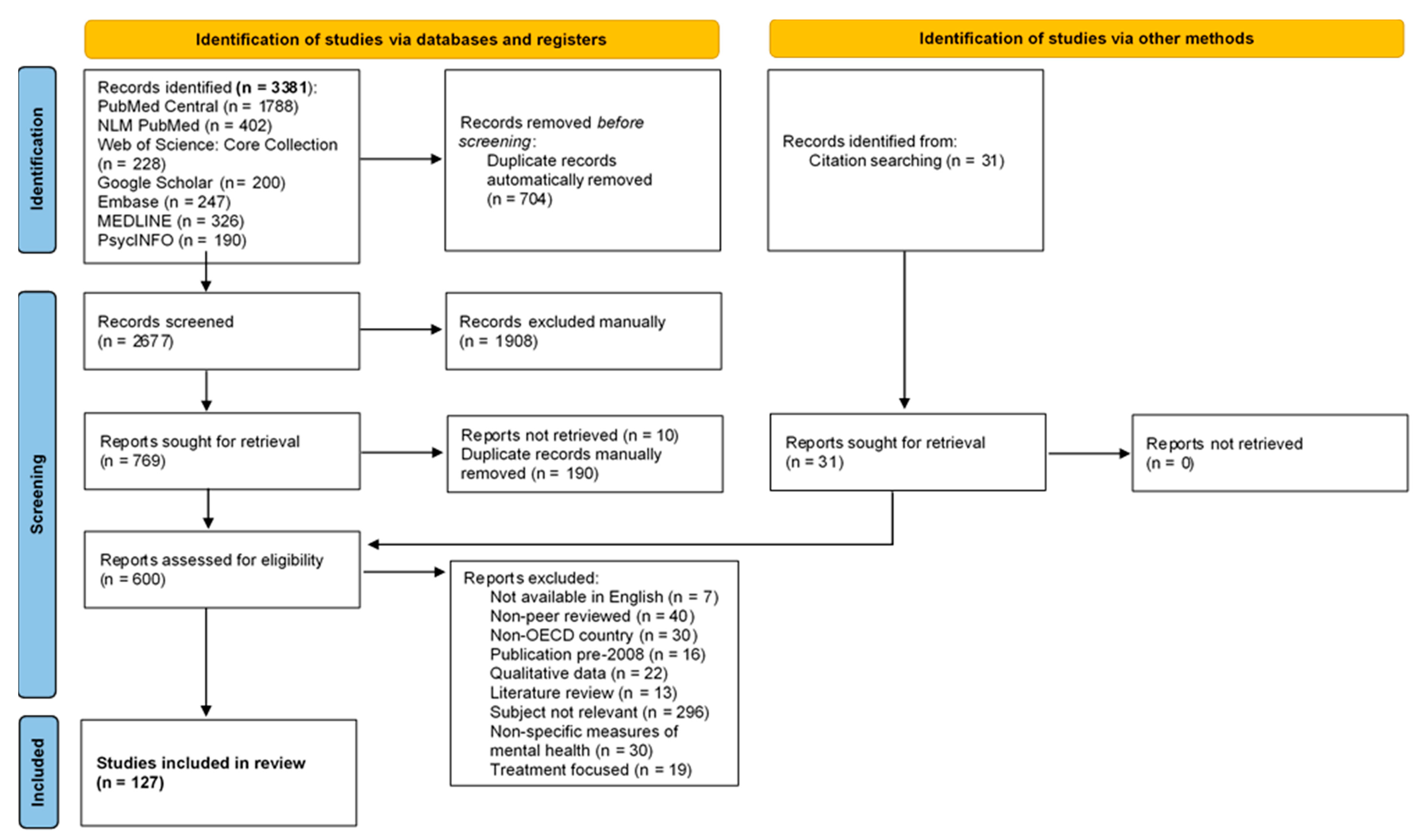

Behavioral Sciences Free Full Text The Impact Of Economic Recessions On Depression Anxiety And Trauma Related Disorders And Illness Outcomes A Scoping Review

What Happens In A Recession How It Impacts Mortgages And Savings And What It Means For You

Housing Recession Sales Plunge To Lockdown Levels Active Listings Surge Prices Begin To Dip As Price Reductions Spike Investors Pull Back R Rebubble

Read Financial Fragility Report Dec19

Deficit Reduction In The United States Wikipedia

Why Rising Mortgage Rates Could Mean Falling Home Sales Zillow Research

Macroview Recessions Are A Good Thing Let Them Happen Seeking Alpha

Doing Good When Times Are Bad Volunteering Behaviour In Economic Hard Times Lim 2015 The British Journal Of Sociology Wiley Online Library

![]()

What Interest Rate Will Trigger The Next Financial Crisis See It Market

Mortgage Rates Hit 4 02 Two Year Yield Spikes By Most Since 2009 Ten Year Yield Goes Over 2 All Heck Breaks Loose Wolf Street

Mortgage Rates Head To 6 10 Year Yield To 4 Yield Curve Fails To Invert And Fed Keeps Hiking Seeking Alpha

What Happens To Housing When There S A Recession Keeping Current Matters

23 Reasons To Buy And Not To Buy A Home In A Recession Va Home Loan Centers