Depreciation recapture formula

Recaptured Depreciation Formula The formula for calculation of recaptured deprecation is Recaptured depreciation Selling price of the asset Deprecated value of. He subtracts 10000 the lesser of the proceeds of disposition of the property minus the related outlays and expenses.

Learn About Depreciation Recapture Spartan Invest

A change in the depreciation method period of recovery or convention of a depreciable asset.

. Finally it explains when and how to recapture MACRS depreciation. Depreciation recapture doesnt add to a taxable gain its a method of determining the tax treatment of any gain. In the private equity context to the extent that the cash investors share of the fair-market-value-based depreciation exceeds the total depreciation calculated based on the.

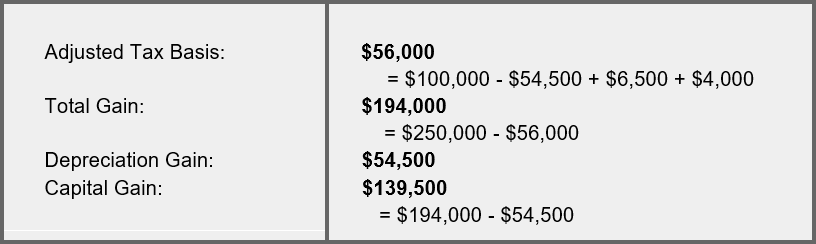

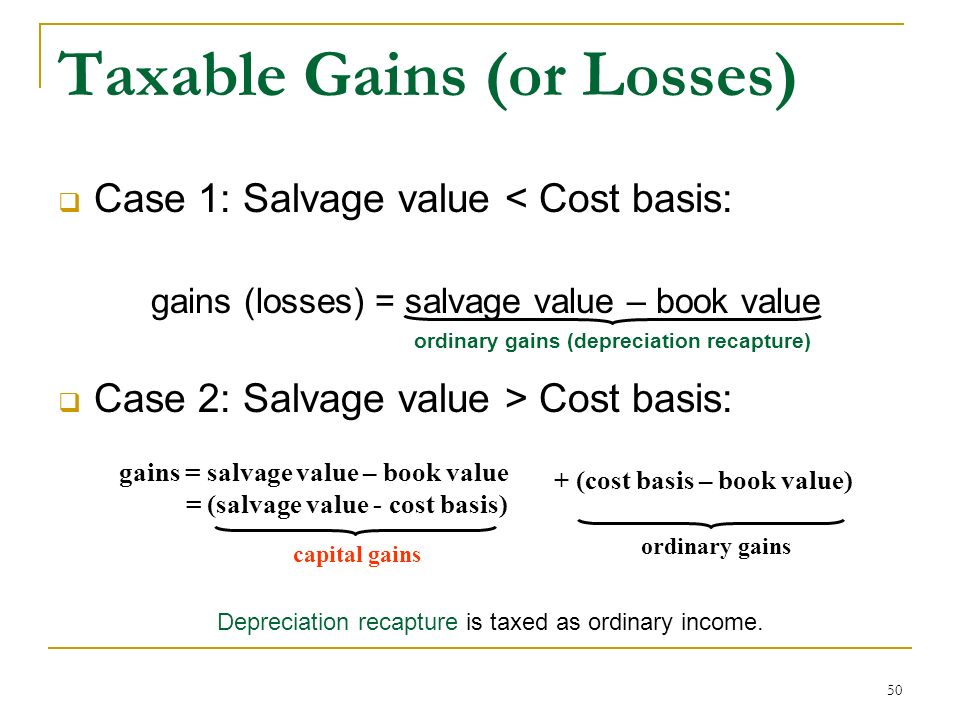

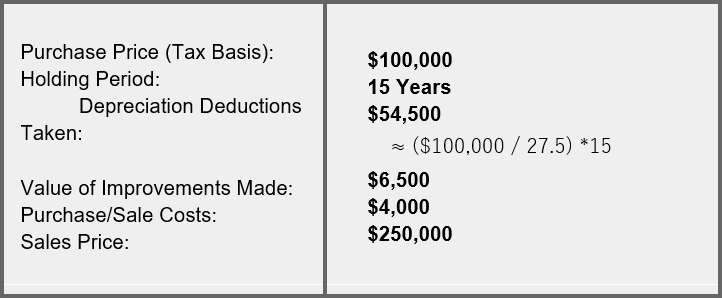

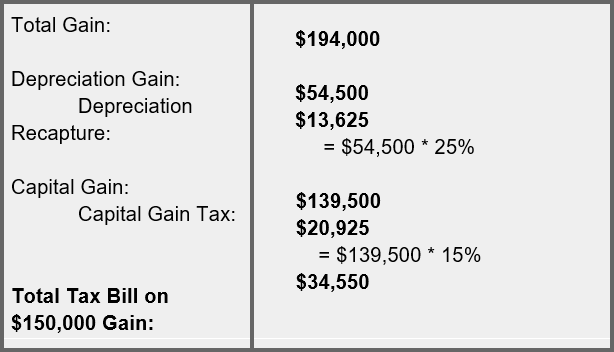

So between 218180 the accumulated depreciation over twenty years and 368180 the realized gain the depreciation recapture will be applied to 218180. Basically depreciation recapture is a method. When an asset is sold at a value above the adjusted basis the gain is taxed as ordinary income up to the amount of depreciation.

Depreciation recapture is associated with the depreciable property and selling the depreciable property results in the ordinary income and reduces the. You can generally figure depreciation on the business use. Regular Method - No.

Heres the formula used to determine basis and depreciation on commercial assets. If you use this method you need to figure depreciation for the vehicle. In this situation the UCC is also 6000 10000 - 4000.

What Is Depreciation Recapture. One common depreciation recapture example involves qualified improvement property QIP. The tax rate will be tied.

Cost of your property minus the value of the landBasis Basis divided by 139ththe amount you can. All allowed or allowable depreciation must be considered at the time of sale. You can claim business use of an automobile on.

Section 1245 depreciation recapture is used to calculate any income tax or capital gains tax you may owe on a sold asset. To calculate this you will start with the cost basis of the item. Your depreciation recapture gain is 102560.

Ad With Decades Of Experience Let Cornerstone Help With Securitized 1031 Replacement Today. Is generally depreciated over a recovery period of 275 years using the straight line method of depreciation and a mid-month convention as residential rental property. Depreciation recapture is a process that allows the IRS to collect taxes on the financial gain a taxpayer earns from the sale of an asset.

Ad Confidently Tackle the Most Complex Tax Planning Scenarios Year-Round. Depreciation Recapture Issues in a 1031 Exchange. Depreciation is a method for spreading out deductions for a long-term business asset over several years.

In this instance your capital gain on the property is 152560 102560 50000. What is depreciation recapture. 6 Multiply your capital gain by the capital gains.

Schedule C Form 1040 Profit or Loss From. The basic way to calculate depreciation is to. The depreciation method used depends on a number of factors including when the investment property was placed into.

QIP includes certain improvements to the interior portion of nonresidential real. Ad Confidently Tackle the Most Complex Tax Planning Scenarios Year-Round. Learn More About the Types of Property Subject to Depreciation Recapture.

Cornerstone Combines The Power Of 1031 Securitized Real Estate. Learn More About the Types of Property Subject to Depreciation Recapture.

Solved A Property Purchased For 100 000 With An Noi Of 7 000 Per 10 Years Will Be Sold For 140 000 There Is No Cost Of Sale Depreciation Taken Course Hero

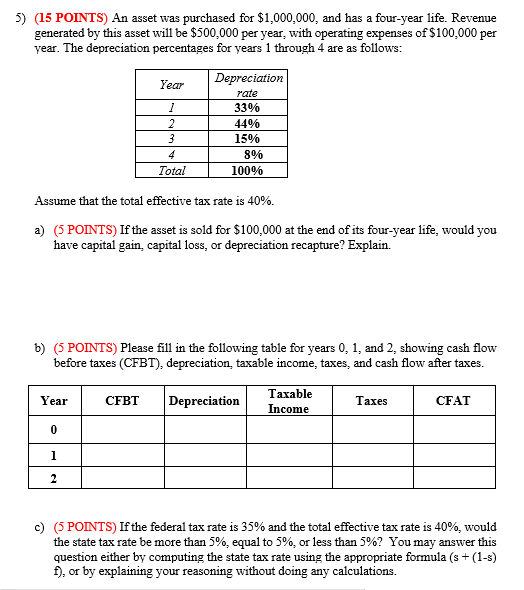

5 15 Points An Asset Was Purchased For 1 000 000 Chegg Com

1031 Exchange And Depreciation Recapture Explained A To Z Propertycashin

Chapter 8 Accounting For Depreciation And Income Taxes Ppt Video Online Download

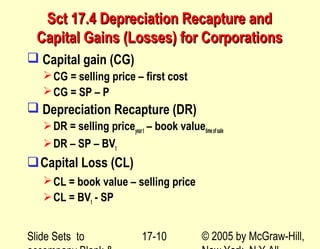

Chapter 2 The Corporate Income Tax Ppt Download

Depreciation Starting With The Basics Ilsoyadvisor

Learn About Depreciation Recapture Spartan Invest

Depreciation And Income Taxes Prezentaciya Onlajn

Learn About Depreciation Recapture Spartan Invest

Chapter 8 Depreciation And Income Taxes Ppt Video Online Download

Rental Property Profit Calculator Watch Quick Video Mortgageblog Com

How To Use Rental Property Depreciation To Your Advantage

Contributed Property In The Hands Of A Partnership

Like Kind Exchanges Of Real Property Journal Of Accountancy

Depreciation And Income Taxes Asset Depreciation Book Depreciation

Chapter 17 After Tax Economic Analysis

Chapter 8 Accounting For Depreciation And Income Taxes Ppt Video Online Download