1099 paycheck calculator

Knowing how much you need to save for self-employment taxes shouldnt be rocket science. Calculate your adjusted gross income from self-employment for the year.

Free Tax Resources Tools And Tips To Simplify Tax Season Lili Banking

The self-employed independent contractors and freelancers.

.jpg)

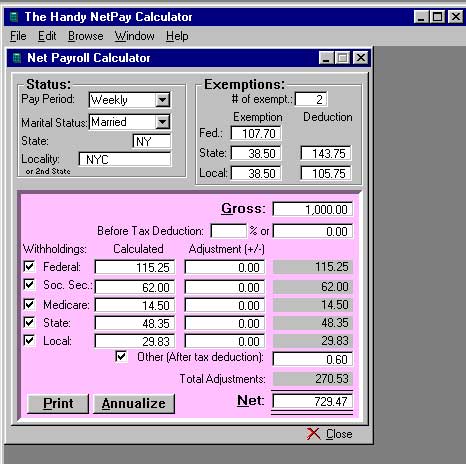

. Use the IRSs Form 1040-ES as a worksheet to determine your. Whether youre a payroll accountant or a small business owner paycheck calculator software is a must for the accuracy of your weekly accounting and for your peace of mind. Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year.

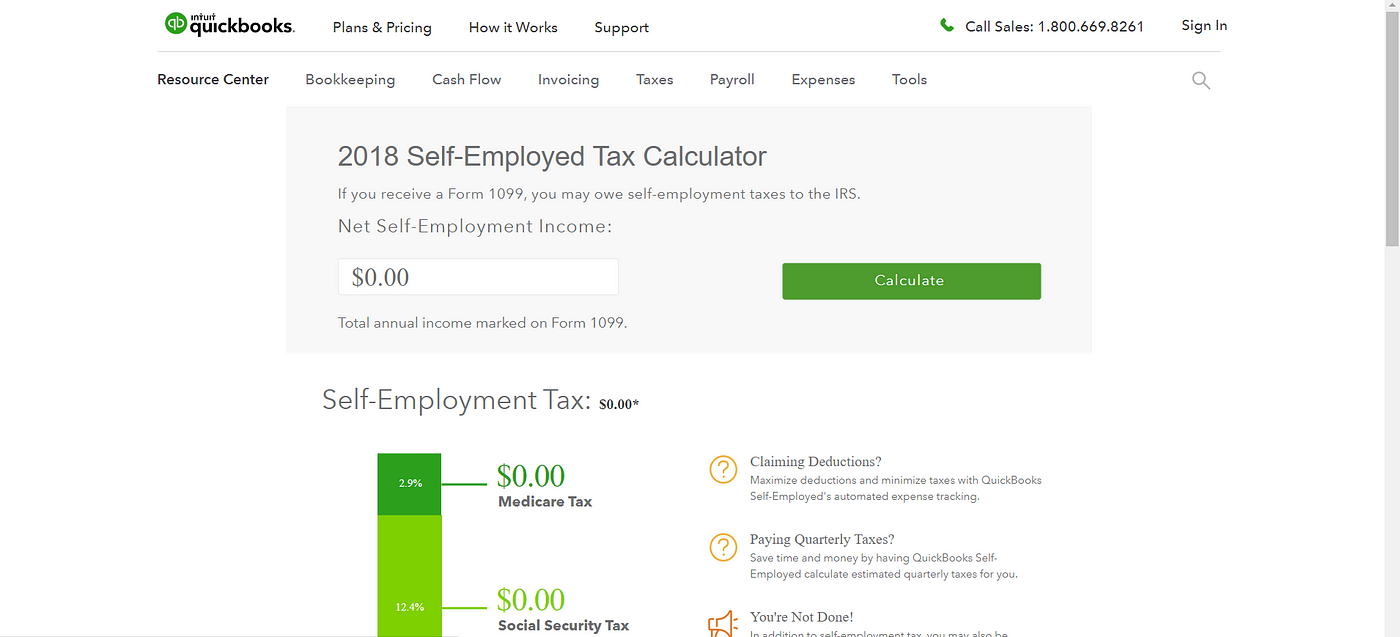

It can also be used to help fill steps 3 and 4 of a W-4 form. Here is how to calculate your quarterly taxes. This calculator provides an estimate of the Self-Employment tax Social Security and Medicare and does not include income tax on the profits that your business made and any other income.

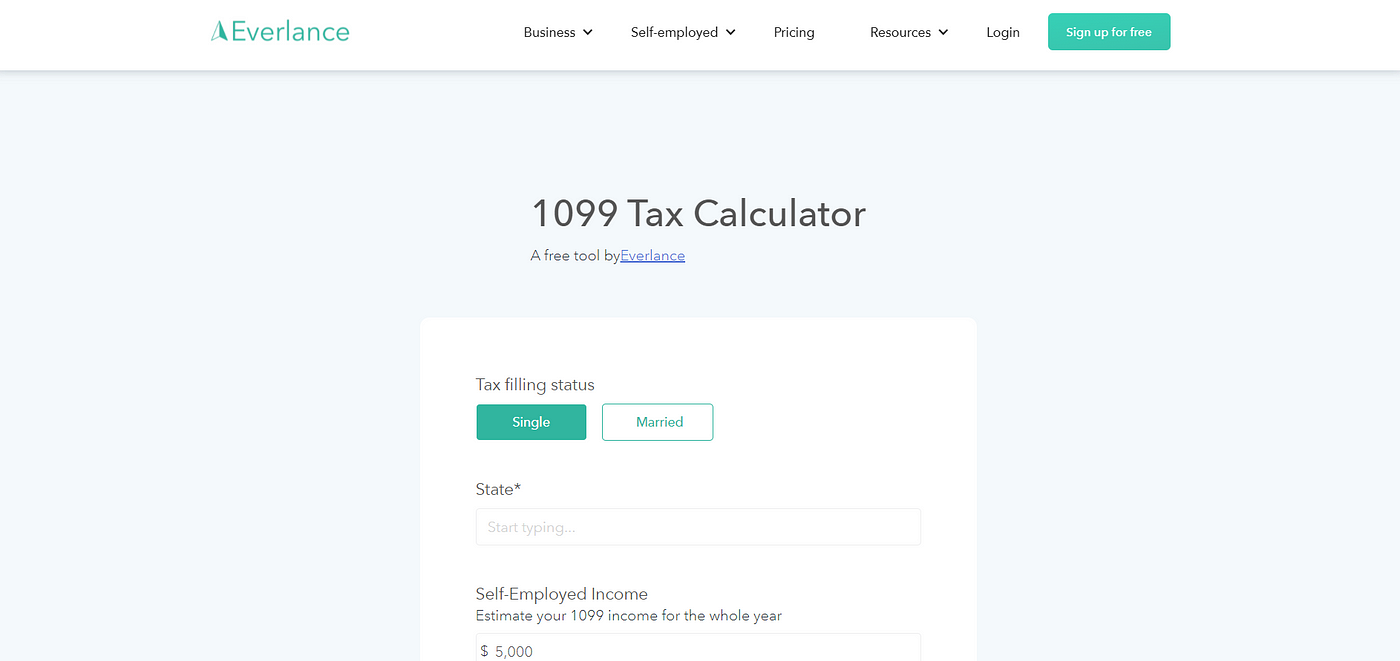

Use our free 1099 self employment tax calculator get your estimate in minutes. Similarly if you choose to invest in a 401k or 403b retirement plan. Next divide this number from the.

This free paycheck calculator makes it easy for you to calculate pay for all your workers including hourly wage earners and salaried employees. ESmartPaycheck offers both a Free Payroll Calculator and full featured Paycheck Manager for your Online Payroll Preparation and Processing needs. The maximum an employee will pay in 2022 is 911400.

If you are enrolled in an employer-provided health insurance plan any premiums you pay will come from your salary. Though your program might work in one state it may be useless in another. Gig workers and others whose net profit is greater than 400 are required to.

If youre a small business owner it can feel like you have more pressing matters at hand. Our calculator preserves sanity saves time and de-stresses self. How do I calculate hourly rate.

Use this calculator to view the numbers side by side and compare your take home income. This varied tax distribution poses a problem for a lot of paycheck calculator software. First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52.

Depending on your income you either pay your taxes yearly or quarterly. Those taxes are constant. Compare your income and tax situation when you work as a W2 employee vs 1099 contractor.

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. To alleviate some of your anxiety we designed a freelance income tax calculator for all types of 1099 workers. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding forms 401k savings and retirement calculator and. Calculate your quarterly tax payments using this free estimated tax calculator. Finding an appropriate and useful paycheck calculator shouldnt be difficult.

Designed for organizations that need. Heres a step-by-step guide to walk you through.

Free Self Employment Tax Calculator Shared Economy Tax

Form 1099 Nec For Nonemployee Compensation H R Block

Self Employed Tax Calculator Business Tax Self Employment Employment

Top 8 Freelance Tax Calculators To Help You Save The Most Freelancer S Handbook

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Estimated Tax Payments For Independent Contractors A Complete Guide

.jpg)

Income Tax Calculator Estimate Your Refund In Seconds For Free

2020 Tax Changes For 1099 Independent Contractors Updated For 2020

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

How Much In Taxes Do You Really Pay On 1099 Income Taxhub

Self Employment Tax Calculator In Excel Spreadsheet Create With Easy Steps

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Top 8 Freelance Tax Calculators To Help You Save The Most Freelancer S Handbook

Estimated Tax Payments For Independent Contractors A Complete Guide

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

W 2 1099 Filer Software Net Pr Calculator

Flyfin Unveils Free 1099 Tax Calculator To Help Filers With Self Employment Tax Financial It